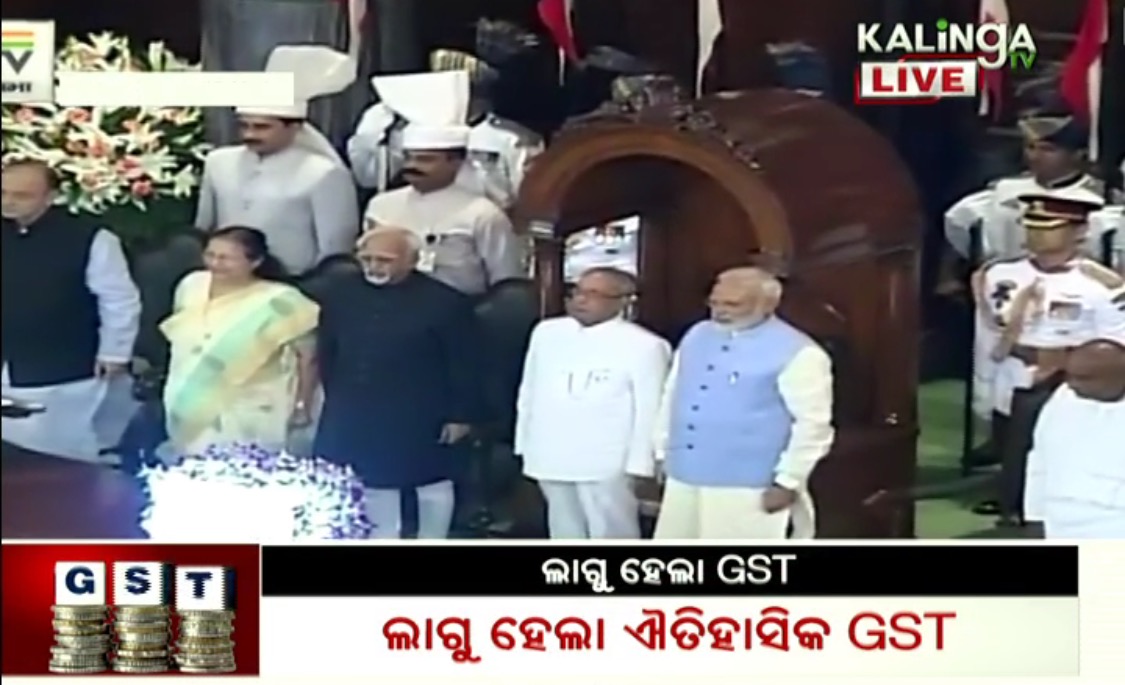

New Delhi: In a historic development in the history of Indian economy, nationwide Goods and Services Tax (GST) has been launched midnight tonight. The new tax regime was unveiled at a function in Central Hall of Parliament after President Pranab Mukherjee & PM Modi rang the GST Bell followed by their speeches.

New Delhi: In a historic development in the history of Indian economy, nationwide Goods and Services Tax (GST) has been launched midnight tonight. The new tax regime was unveiled at a function in Central Hall of Parliament after President Pranab Mukherjee & PM Modi rang the GST Bell followed by their speeches.

Apart from PM Modi and President Pranab Mukherjee, Vice President Dr. Hamid Ansari, Lok Sabha Speaker Sumitra Maharajan, former PM HD Devegowda and other senior leaders were present at the occasion.

Former PM Dr. Manmohan Singh skipped the even owing to Congress party’s boycott of the launch ceremony.

“GST does not belong to any single party or govt. It’s a collective effort. It’s a proud moment for the nation. It will redefine Ondian Economy. It’s for the benefit of all,” said PM Modi.

“Gita had 18 chapters and Goods and Services Tax is a reality after 18 meetings, said PM Modi.

“Introduction of GST is a momentous event for the nation,” said President Pranab Mukherjee.

The new tax regime replaces more than a dozen state and central levies built up over seven decades, with a one national GST unifying the country’s economy and over 100 crore people into a common market.

The impact of the GST on the prices of goods and services will largely depend on the item in question. It will also depend upon the respective State governments and their intervention with respect to controlling prices of essential commodities.

Broadly, services are expected to become costlier under the GST regime, as the expected GST rate would be higher than the existing service tax rate of 15%. However, the GST is expected to bring down prices of indigenously manufactured goods on account of current effective indirect taxes.

Price of certain category of goods may come down depending on the effective rate of indirect taxes being paid at present and the tax brackets under which goods are classified under the GST.

Price of certain category of goods may come down depending on the effective rate of indirect taxes being paid at present and the tax brackets under which goods are classified under the GST.

Price of some necessary consumers’ goods such as milk, fruits, fresh vegetables, rice, wheat , egg, mustered oil, salt etc will not come under GST net. However, sugar, coffee, frozen food, branded paneer etc. will be come under 5% GST. Other goods milk processed item like butter, cheese, ghee etc will be charged 12% GST.

The cost of AC Hotel staying , branded garments, stainless steel, gas stove etc. will come under 18% GST, while refrigerator, TV, Washing-machine, musical instruments etc. will be charged 28% GST. On the other hand, Diesel car, two-wheeler, cigarette etc. will be charged 28% GST and cess.

Ms Kalinga

Ms Kalinga