LIC’s Bima Jyoti is a Non-Linked, Non-Participating, Individual, Life Assurance Savings Plan which offers an attractive combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the policyholders during the policy term and guaranteed lumpsum payment to the surviving policyholder at the time of maturity. This plan also takes care of liquidity needs through loan facility. This plan can be purchased Offline through agent /other intermediaries as well as Online directly through website www.licindia.in

Benefits payable under an in-force policy (where all due premiums have been paid):

Death Benefit of LIC Bima Jyoti Policy

(i) On death during the policy term before the date of commencement of risk. Return of premiums paid excluding taxes, extra premium and rider premium(s), if any.

(ii) On death during the policy term after the date of commencement of risk “Sum Assured on Death” and Accrued Guaranteed Additions. Where “Sum Assured on Death” is defined as higher of 125% of Basic Sum Assured or 7 times of annualised premium.

Death Benefit as mentioned in A (ii) above shall not be less than 105% of the total Premiums paid (excluding any extra premium, any rider premium(s) and taxes) up to the date of death.

Maturity Benefit of LIC Bima Jyoti Policy

On Life Assured surviving the stipulated Date of Maturity provided the policy is in-force, “Sum Assured on Maturity” along with Guaranteed Additions, shall be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Guaranteed Additions of LIC Bima Jyoti Policy

Provided the policy is in-force by payment of due premiums, Guaranteed Additions at the rate of Rs 50 per thousand Basic Sum Assured will be added to the policy at the end of each policy year. In case of death under in-force policy, the Guaranteed Addition in the year of death shall be for full policy year. In case the premiums are not duly paid, the Guaranteed Additions shall cease to accrue under a policy.

In case of a paid-up policy or on surrender of a policy, the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Eligibility Conditions and Other Restrictions of LIC Bima Jyoti Policy

- Minimum Basic Sum Assured: Rs. 1,00,000

- Maximum Basic Sum Assured (Basic Sum Assured shall be in multiples of : No limit Rs 25,000/-)

- Policy Term: 15 to 20 years

- Premium Paying Term: Policy Term minus 5 Years

- Minimum Age at entry: 90 days Completed

- Maximum Age at Entry: 60 Years (Age Nearer Birthday)

- Minimum Age at Maturity: 18 years (Completed)

- Maximum Age at Maturity: 75 Years (Age Nearer Birthday)

- 65 Years (Age Nearer Birthday) for policies procured through POSP-LI

Date of commencement of risk of LIC Bima Jyoti Policy

- In case the age at entry of the Life Assured is less than 8 years, the risk under this plan will commence either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

Date of vesting in LIC Bima Jyoti Policy

- If the policy is issued on the life of a minor, the policy shall automatically vest on the Life Assured on the policy anniversary coinciding with or immediately following the completion of 18 years of age and shall on such vesting be deemed to be a contract between the Corporation and the Life Assured.

Settlement Option (for Maturity Benefit) of LIC Bima Jyoti Policy

- Settlement Option is an option to receive Maturity Benefit in instalments over the chosen period of 5 or 10 or 15 years instead of lump sum amount under an in-force as well as Paid-up policy. This option can be exercised by the Policyholder during minority of the Life Assured or by the Life Assured aged 18 years and above, for full or part of the maturity proceeds payable under the policy. The amount opted for this option by the Policyholder/ Life Assured (i.e. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

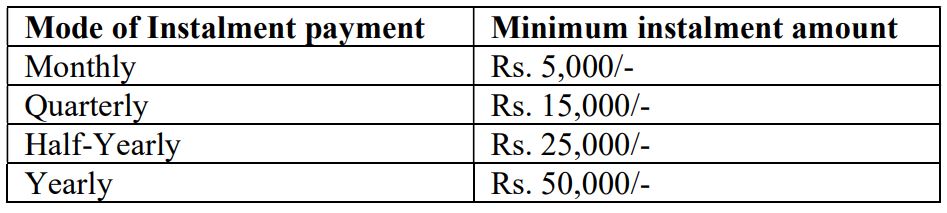

- The instalments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for different modes of payments being as under as under:

LIC Bima Jyoti Policy premiums payment

- Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly intervals (monthly premiums through NACH only) or through salary deductions.

LIC Bima Jyoti Policy Grace Period

- A grace period of 30 days shall be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums from the date of First Unpaid Premium. During this period, the policy shall be considered in-force with the risk cover without any interruption as per the terms of the policy. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

- The above grace period will also apply to rider premiums which are payable along with premium for Base Policy.

Ms Kalinga

Ms Kalinga