New Delhi: Income Tax Return season is here. The last date for the same is July 31 and most of us might be in the middle of completing the process.

By filing your ITR on time, along with certain benefits such as carry forward of losses, you will also avoid paying late filing fees. If you file your ITR after the deadline you will have to pay late filing fees of up to Rs 10,000.

Also Read: IRDAI Alters Norms For Life Insurance Products

Everyone apart from super senior citizens (i.e., aged 80 years and above) have to file Income Tax Return digitally.

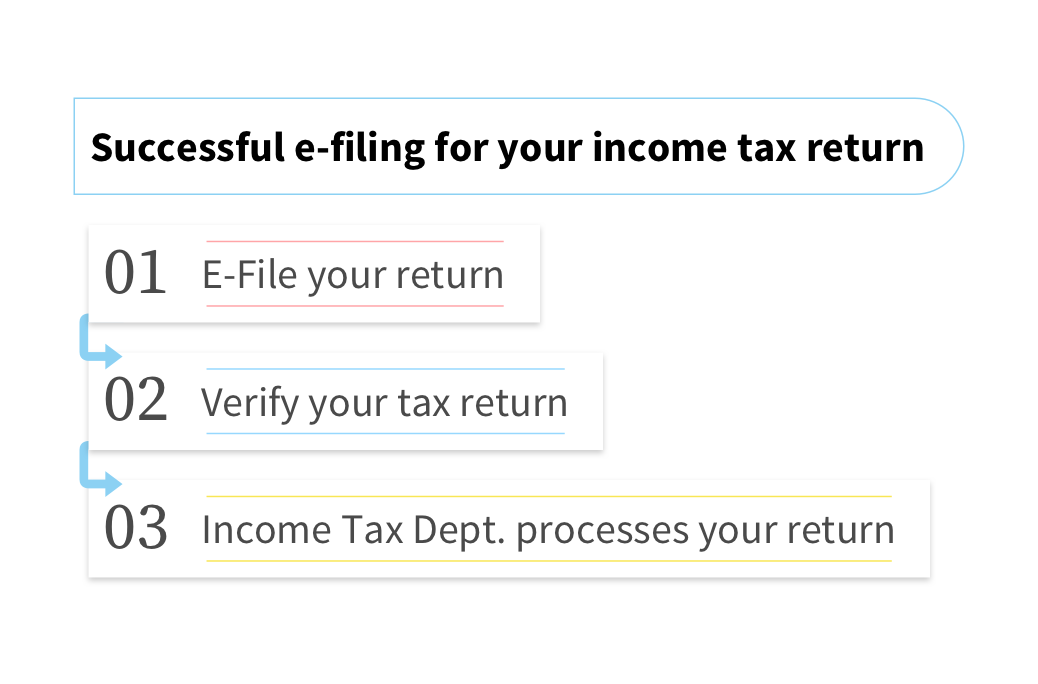

Follow these simple steps for a hassle-free filing process.

-

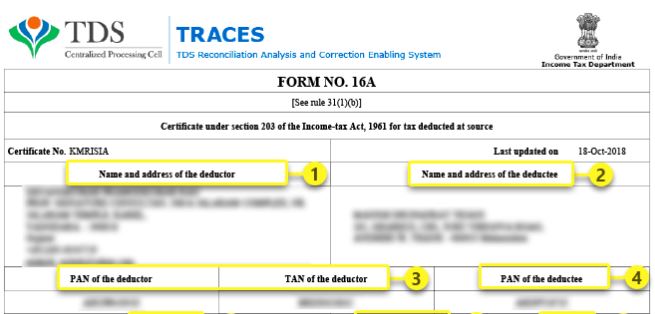

Collect required documents such as TDS certificates (Form16/16A), capital gains statements

The first step is to collect all the documents you will need to file your ITR such as Form 16, salary slips, and interest certificates. The documents will help you compute your gross taxable income and will provide you with the details of tax deducted at source (TDS) from your income in FY 2018-19.

-

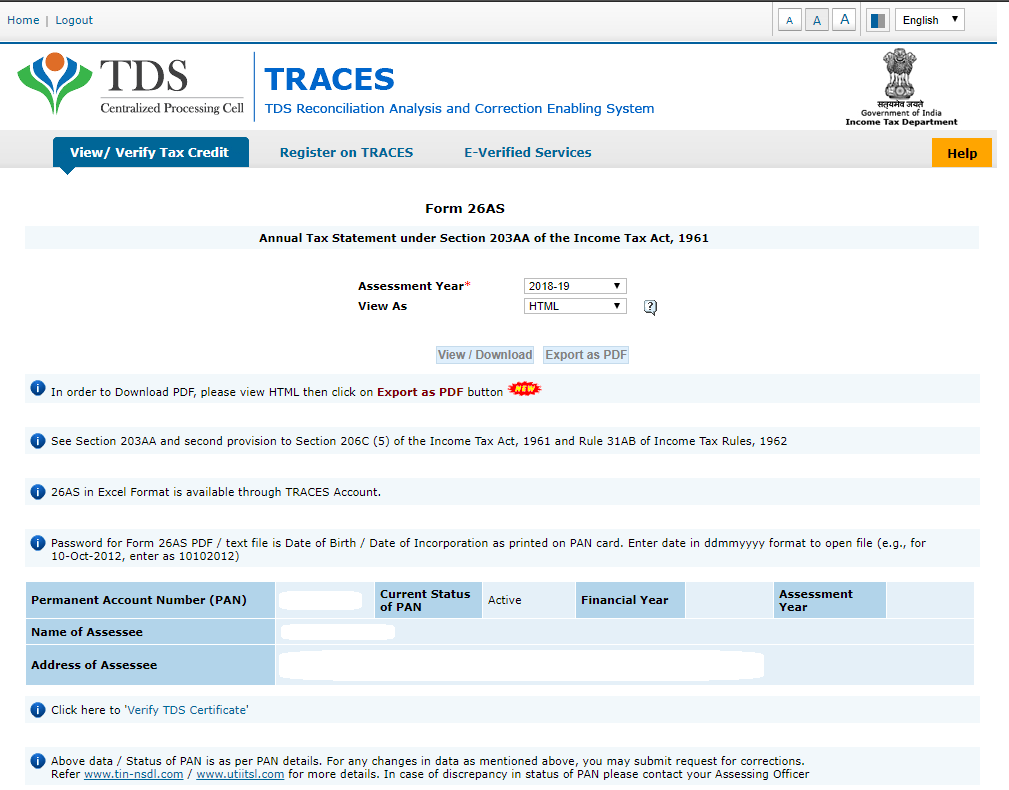

Download and check Form 26AS

Form 26AS is your tax passbook which consists of all the details of the tax that has been deducted from your income during the FY 2018-19 and deposited against your PAN. You must cross-check your TDS certificates with Form 26AS to ensure that tax deducted from your incomes such as salary, interest etc is deposited with the government and against your PAN.

You can download Form 26AS from the TRACES website.

-

Rectify the errors in Form 26AS, if any

If the amounts shown in the TDS certificates (Form-16, Form-16A etc.) and Form 26AS do not match, then you must take up the matter with your deductor to get the errors rectified. The deductor can be your employer, bank or others and request him to correct the details.

-

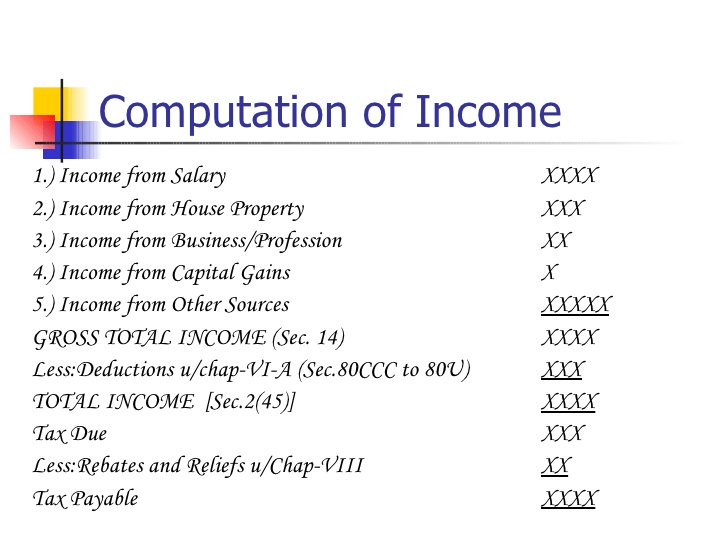

Compute total income for the financial year

Once you have collected all the documents needed and verified all the taxes that are deducted from your income, you are required to compute the total income chargeable to tax.

-

Compute your tax liability

After computing your total income, you have to calculate your tax liability by applying the tax rates in force for FY 2018-19 as per your income slab. The income tax slabs and rates have remained unchanged for FY 2018-19 as compared to the previous year.

-

Calculate final tax payable, if any

Once you have computed your tax liability in the earlier step, deduct the taxes that have been already paid by you through TDS, TCS and Advance Tax during the year. Add interest, if any, payable under sections 234A, 234B and 234C.

This will tell you if all the taxes are already paid by you or any additional tax has to be paid or if you have paid any excess taxes and a refund is due to you.

-

File income tax return after all taxes are paid

Once taxes, if any due, are paid by you, you can start the process to file your ITR. If you want to claim any refund from the tax department, you can do so only if you file your ITR. Therefore, you will have to file your ITR even if you are not mandatorily required to do so as per rules.

-

Verification of ITR

The last step of the ITR filing process is verification. Remember after you file your ITR, you have 120 days to verify it. If you do not verify your ITR, then it will be deemed as you have not to file ITR. In case you forget to verify your ITR before the deadline, you can file a request to your assessing officer.

-

E-verification acknowledgement

If you verify your ITR using an electronic method, then you will immediately receive the confirmation from the tax department regarding verification of your ITR. If you have sent ITR-V via post to the I-T department, they will send you an email confirming that your ITR-V has been received by the I-T department.

-

IT department will process a return after verification

After the return is verified, either via e-verification or physically, the income tax department will start processing your tax return. This is to ensure that all the details filled by you are correct as per the Income Tax Act and also cross-check the details filled by you with other data available with it.

Ms Kalinga

Ms Kalinga