People are arranging pension for their families every month by investing in Life Insurance Corporation of India (LIC) policy. LIC has different policies which are designed keeping in mind every income group. Employees often have pension concerns. On the other hand, people who have come close to retirement are most worried about it.

In such a situation, LIC’s ‘Jeevan Shanti’ pension policy relieves the customers from this tension. This policy gives future security to the common man. You will start getting pension immediately after investing only once in this policy. It is mandatory to be at least 30 years of age to invest in it. At the same time, the maximum age of the policy holder should be 85 years to get instant pension.

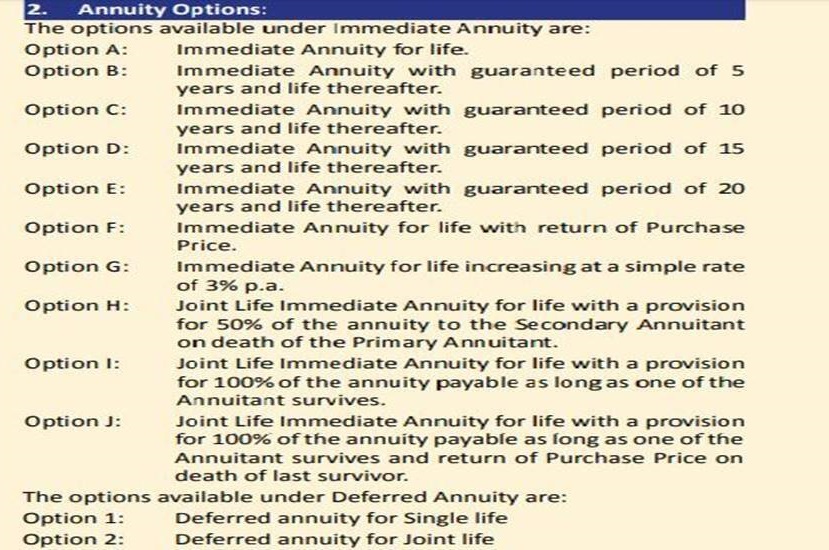

If you do not want a pension immediately, you can start it even after 5, 10, 15 or 20 years. That is, the sooner the pension starts, the more benefit you will get. While investing, customers have two options to choose the pension. In which the first is intermediate and the second is deferred annuity. Immediate means pension immediately after investment, while deferred annuity means payment of pension after some time (5, 10, 15, 20 years).

There is a minimum sum assured of Rs 1.5 lakh and there is no limit for the maximum. The loan can be done 1 year after the commencement of the pension and 3 months after the surrender, the pension is started. In this policy, you can get a pension of 4 lakh rupees every month. You can get a pension every month immediately after depositing a lump sum. You can buy this policy online through an agent or by visiting the LIC website at home.

If you take a lump sum of Rs 90000000 in this policy and choose the intermediate option, then you will get a pension of Rs 454500 every month. Let’s try to understand this with an example: –

Age: 36

Sum Assured: 90000000

Lump sum premium: 91620000

Pension:

Annual: 5634000

Half Yearly: 2767500

Quarterly: 1373625

Monthly: 454500

Suppose if a person of 36 years chooses option ‘A’ i.e. Immediate Annuity for life (pension per month). In addition, he chooses the sum assured option of Rs 90000000. So he has to pay a lump sum premium of Rs 91620000. After this investment, he will get a pension of Rs 454500 per month. This pension will be received as long as the policyholder remains alive.

Ms Kalinga

Ms Kalinga