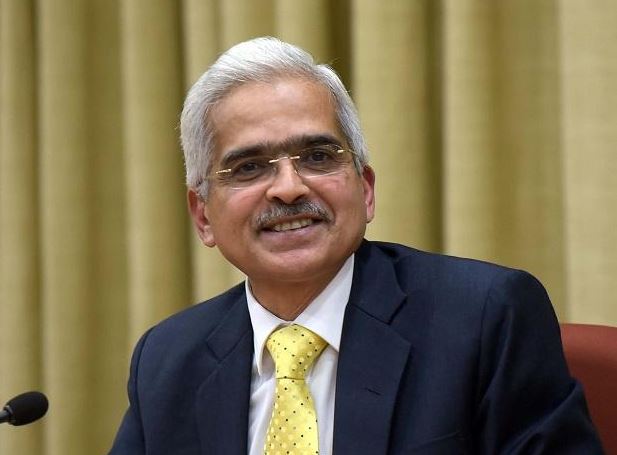

New Delhi, Aug 6 (IANS) Shaktikanta Das, the Governor of the Reserve Bank of India (RBI) has stressed on continued policy support from all sides, including monetary and fiscal in order to enhance the nascent recovery that the economy is witnessing.

In a virtual address post the monetary policy committee’s meeting, Das said that the outlook for aggregate demand is improving, but the underlying conditions are still weak. Further, aggregate supply is also lagging below pre-pandemic levels.

He was of the view that while several steps have been taken to ease supply constraints, more needs to be done to restore supply-demand balance in a number of sectors of the economy.

The recent inflationary pressures are evoking concerns, but the current assessment is that these pressures are transitory and largely driven by adverse supply-side factors, he said.

The Governor observed that the economy is in the midst of an extraordinary situation arising from the pandemic.

“The conduct of monetary policy during the pandemic has been geared to maintain congenial financial conditions that nurture and rejuvenate growth. At this stage,therefore, continued policy support from all sides — fiscal, monetary and sectoral — is required to nurture the nascent and hesitant recovery.”

To continue with its growth supporting stance, the RBI has retained its key short-term lending rates during the third monetary policy review of FY22.

Besides, the growth-oriented accommodative stance was retained to give a push to economic activity despite high retail inflation levels.

The Monetary Policy Committee (MPC) of the central bank voted to maintain the repo rate, or short-term lending rate, for commercial banks at 4 per cent.

Likewise, the reverse repo rate was kept unchanged at 3.35 per cent, and the marginal standing facility (MSF) rate and the ‘Bank Rate’ at 4.25 per cent.

Ms Kalinga

Ms Kalinga