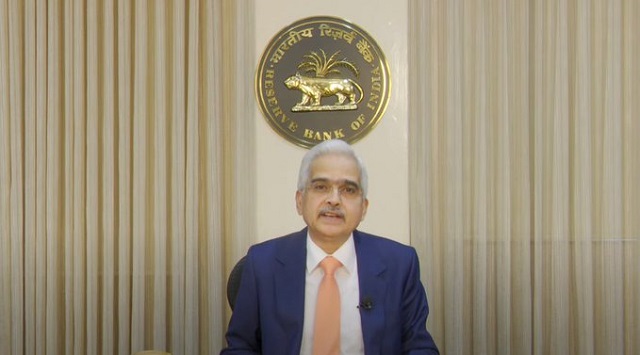

RBI Monetary policy: Repo rate remains unchanged at 6.5 %

RBI governor Das said, The monetary policy committee unanimously decided to keep the repo rate unchanged at 6.50 per cent

New-Delhi: The Reserve Bank of India (RBI) has announced that there will be no change in repo rate. The Monetary Policy Committee (MPC) decided to keep the repo rate at 6.5 per cent.

Announcing the statement of monetary policy, the first in the current financial year, RBI governor Das said, “The monetary policy committee unanimously decided to keep the repo rate unchanged at 6.50 per cent.”

In the same vein, the RBI Governor added the war against inflation to continue till the decline in inflation rate is closer to the target — 4 per cent.

“We are on the right track to bring down the inflation rate,” Das said, adding that the MPC will not hesitate to take further action to fight inflation.

The Indian inflation rate is 6.4 per cent as per February 2023 data.

According to him for FY24 the inflation rate is predicted at 5.2 per cent with Q1 5.1 per cent, Q2 5.4 per cent, Q3 5.4 per cent and Q4 5.2 per cent.

On the economic growth, Das said the gross domestic product (GDP) for FY23 was 7 per cent.

For FY24, the GDP growth is expected at 6.5 per cent with Q1 5.1 per cent, Q2 5.4 per cent, Q3 5.4 per cent, Q4 5.2 per cent.

Das said the risks are evenly balanced for both inflation and GDP growth projections.

The decision to keep the repo rate unchanged has taken the market by surprise as majority predicted a hike of 25 bps.

However, it was only the State Bank of India economists who had predicted that the RBI may not hike the repo rate.

Ms Kalinga

Ms Kalinga