The Life Insurance Corporation (LIC) has launched a new policy named ‘Dhan Rekha.’ LIC’s Dhan Rekha policy is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan which offers an attractive combination of protection and savings.

This plan provides financial support for the family in case of the unfortunate death of the policyholder during the policy term. Periodic payments will also be made on the survival of the policyholder at specified durations during the policy term and guaranteed lumpsum payments to the surviving policyholder at the time of maturity.

The Dhan Rekha also takes care of liquidity needs through a loan facility. This plan can be purchased Offline through agent /other intermediaries as well as Online directly through website www.licindia.in.

Dhan Rekha Death Benefit

- Death Benefit payable on death during the policy term after the date of commencement of risk shall be “Sum Assured on Death” along with Accrued Guaranteed Additions.

- For Single premium payment, “Sum Assured on Death” is defined as 125% of Basic Sum Assured.

- For Limited premium payment, “Sum Assured on Death” is defined as the higher of 125% of Basic Sum Assured or 7 times of annualized premium.

- The Death Benefit under Limited Premium payment shall not be less than 105% of total premiums paid excluding any extra premium, any rider premium(s), if any, and taxes as on date of death.

- However, in case of minor Life Assured, whose age at entry is below 8 years, on death before the commencement of Risk (as specified in Para 2 below), return of premium(s) paid excluding taxes, any extra amount chargeable under the policy due to underwriting decision and rider premium(s), if any, shall be payable.

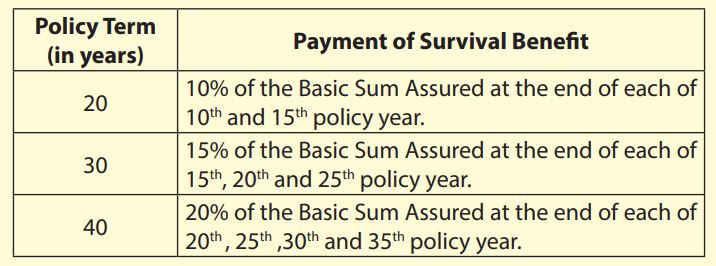

Dhan Rekha Survival Benefit

- On the life assured surviving to each of the specified duration during the policy term, provided policy is in-force, a fixed percentage of Basic Sum Assured shall be payable. The fixed percentage for various policy terms is as below:

Dhan Rekha Maturity Benefit

- On Life Assured surviving the stipulated Date of Maturity provided the policy is in-force, “Sum Assured on Maturity” along with accrued Guaranteed Additions, shall be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

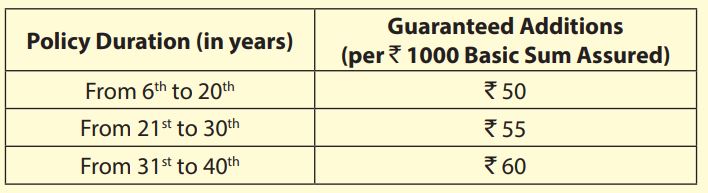

Dhan Rekha Guaranteed Additions

- Guaranteed Additions shall be payable, provided the policy is in-force by payment of due premiums. The Guaranteed Additions shall accrue at the end of the Policy Year from the 6th Policy Year to the end of the Policy Term. The rate of Guaranteed Additions shall increase in steps with the duration of the policy as specified below:

In case of death under in-force policy, the Guranteed Addition in the year of death shall be for full policy year. In case of limited premium policy, if the premiums are not duly paid, the Guaranteed Additions shall cease to accrue under a policy. In case of a paid-up policy or on surrender of a policy, the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Dhan Rekha Eligibility Conditions and Other Restrictions

- Minimum Basic Sum Assured: Rs 2,00,000

- Maximum Basic Sum Assured: No limit

- (Basic Sum Assured shall be in multiples of Rs 25,000)

Dhan Rekha Policy Term

- 20 years, 30 years and 40 years (20 years in case of policies procured through POSP-LI/CPSC- SPV l)

Dhan Rekha Premium Paying Term

- Single Premium: Not Applicable Limited Premium, 10 years for Policy Term 20 years, 15 years for Policy Term 30 years, 20 years for Policy term 40 years

Dhan Rekha Minimum Age at Entry

- 8 years (Completed) for Policy Term 20 years, 3 years (Completed) for Policy Term 30 years, 90 days (Completed) for Policy Term 40 years

Dhan Rekha Minimum installment amount

- Monthly: Rs 5,000

- Quarterly: Rs 15,000

- Half-Yearly: Rs 25,000

- Yearly: Rs 50,000

Kalinga AI

Kalinga AI