RBI Monetary Policy: MPC keeps repo rate unchanged at 6.5%

The Reserve Bank of India's (RBI) monetary policy committee (MPC) on Thursday has decided to keep the repo rate unchanged at 6.5%

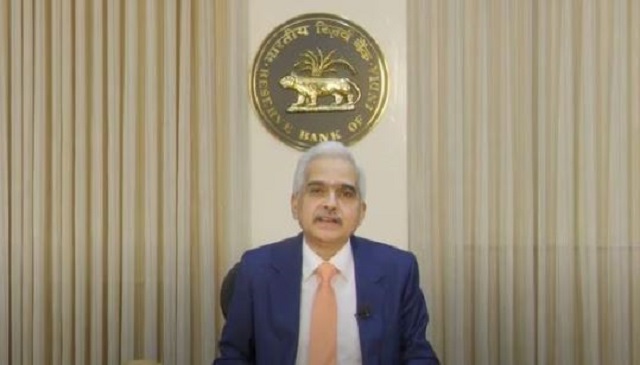

New-Delhi: The Reserve Bank of India’s (RBI) monetary policy committee (MPC) on Thursday has decided to keep the repo rate unchanged at 6.5%, RBI governor Shaktikanta Das said.

The MPC also decided by a majority of five out of six members to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth: RBI Governor Shaktikanta Das

The MPC retained the repo rate at 6.5% in its first bimonthly policy meeting for the new fiscal year 2023–24 (FY24), which was held on April 6. Since last May, the repo rate has already been increased by a total of 250 basis points in an effort to bring down in inflation.

In April, the RBI’s MPC unanimously decided to keep the repo rate unchanged at 6.50 per cent, after raising it continuously since May 2022 by a total of 250 basis points to keep the country’s inflation in check. The central bank had maintained its stance of “withdrawal of accommodation” in its bimonthly meeting in April.

In April, the consumer price index-based (CPI) inflation declined to an 18-month low of 4.7 per cent, from 5.7 per cent in March, within the RBI’s 2-6 per cent target band.

Kalinga AI

Kalinga AI